Advanced search

Search Results: 253 results for keyword "bad debt".

Vigilance over bad debt essential

20-05-2023 10:00

As bad debts continue to pose a threat to the banking sector's performance, financial authorities are implementing a host of measures to keep tabs on credit quality and mitigate risk to optimise the efficiency of credit institution restructuring.

Bad bank debts cast shadow over profit outlook

06-05-2023 12:10

Several banks have posted low profit growth in the first quarter (Q1) of this year, with some even seeing negative growth, mostly due to a spike in non-performing loans (NPLs), leading to soaring provisioning costs.

Credit growth slowing down, raising fear of business contraction

13-03-2023 14:47

Credit growth in the first months of this year slowed significantly due to high interest rates and firms’ poor health, raising concerns about rising bad debts.

Rising bad debt threat looms large

09-02-2023 12:33

Despite a bright business outlook, non-performing loans are causing significant concerns to banks amid a challenging environment in both the domestic and global market, according to industry experts.

Bad debts continue to soar at commercial banks

06-02-2023 12:21

The rate of bad debt is rising at commercial banks and is expected to increase further amid real estate market woes.

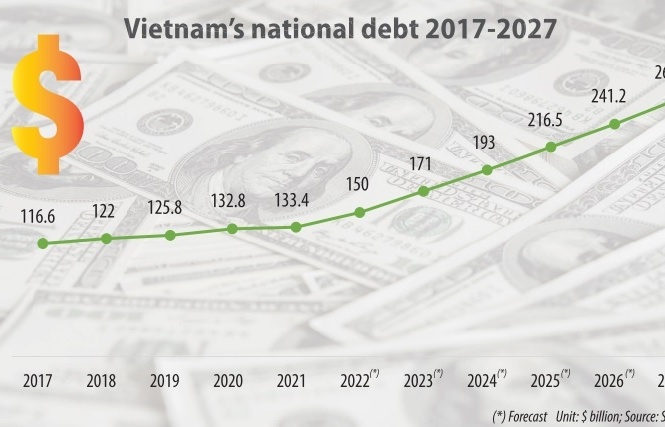

Debt rates set to remain lower than planned limits

28-12-2022 17:04

With Vietnam’s borrowing plan revealed and budget landscape finalised for next year, Vietnam is expected to see its public debt stay within the permissible limit, ensuring financial security for the nation.

Growing bond market illustrating bad debt snags

13-12-2022 18:39

While the bad debt market in Vietnam is still in its infancy and positive conditions have converged, stronger steps need to be taken.

VAT refund delays cause fear of bad debt for wood groups

17-11-2022 16:00

As VAT refunds represent a crucial part of the cash flow of timber processors, the current delay is throwing a wrench in the operations of woodchip, furniture, and other timber-based producers, leading related associations to call for easier regulations.

Banks post uplifting results despite underlying risks

20-10-2022 16:00

Despite bullish business results in the first nine months of the year, many commercial banks in Vietnam are facing a risk of rising bad debts.

Banks moving to restructure bad debts

26-09-2022 16:31

As a circular on debt rescheduling for clients affected by the pandemic has expired, banks will face several scenarios to deal with in terms of debt restructuring.

Cost-cutting measures aid debt drop

01-09-2022 21:04

Vietnam is witnessing a strong reduction in its public debt following its close control of the issue, with the government exercising a stringent policy on increasing revenues and reducing expenditures.

Major reform agenda key to control debt

20-07-2022 18:30

Vietnam is set to see a higher-than-expected budget deficit this year due to financial measures to support enterprises, but its public debt is projected to remain controlled.

NA approves extension of pilot bad debt settlement resolution

20-06-2022 09:39

The National Assembly (NA) has agreed to extend a pilot resolution on bad debt settlement until the end of 2023 instead of this year.

Strengthened debt control underway

14-06-2022 10:00

In a bid to continue ensuring the country’s financial healthy situation, the National Assembly and the government have continued underscoring stringent management of the state budget as a solution to continue ensuring a safe public debt level.

Real estate progress hits credit curbs

30-05-2022 19:39

With the movement to limit lending to the real estate sector along with the tightening of bond issuance, capital inflow into the real estate market is being congested.

Mobile Version

Mobile Version